estate trust tax return due date

If you pick Dec. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

Unexpected Tax Bills For Simple Trusts After Tax Reform

For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month.

. Trust and Estate UK. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later. The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the.

The form to file is 1041 the income-tax return for trusts and estates. For Marees estate income year one is 5 March 2022 to 30 June 2022. Report income distributions to beneficiaries and to the IRS on.

For a T3 return your filing due date depends on the trusts tax year-end. Federal estate tax returns are due no later than 9 months. When you send us both the Form 706 and the state estate tax return we issue a certificate of no tax due for your records.

Look for form RPD-41058Estate Tax Return on our web site. For example for a trust or estate. File an amended return for the estate or trust.

The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year. For calendar-year file on or before April 15 Form 1041 US. Deceased estate trust tax returns.

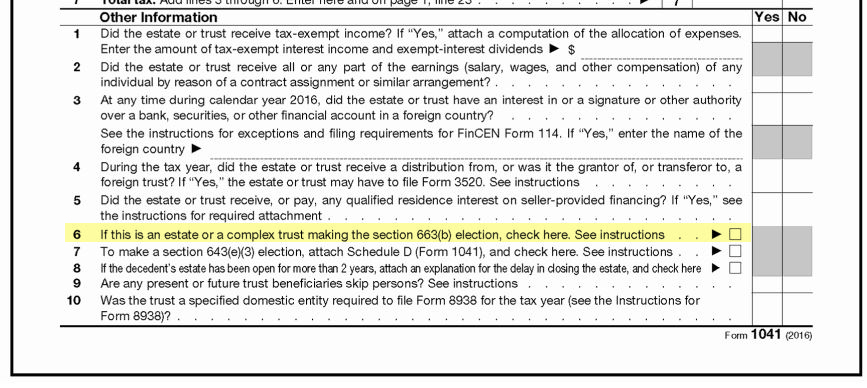

Form 1041. Maryland Instructions for Fiduciaries. However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries.

Estate Tax Return for decedents. Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries. The fiduciary of a domestic decedents estate trust or.

Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or domestic trust for which he or she acts. Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. 31 for instance that gives you until April 15.

Three years after the date your original return was filed or. If your federal change decreases the tax due to. The tax return and payment are due nine months after the estate owners date of.

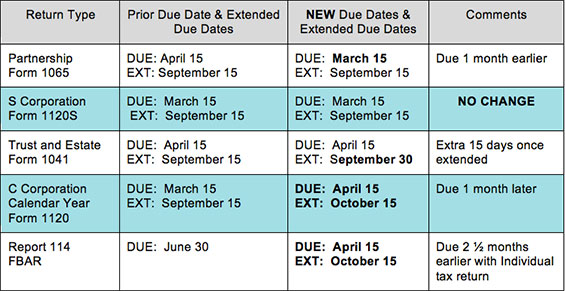

One year after the date your Illinois tax was paid whichever is latest. Instructions for filing fiduciary income tax returns. 13 rows Only about one in twelve estate income tax returns are due on April 15.

Income from membership of Lloyds. The estates income is 9500 which is below the tax-free. In this income year.

The first payment for a fiscal year filer must be filed on or before the 15th day. Please note that the. Trust and Estate Trade.

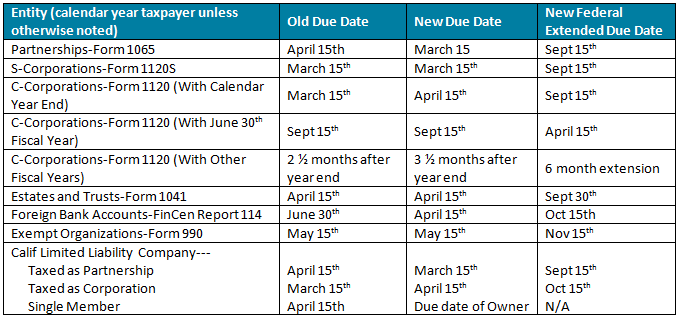

Due Date for Estates and Trusts Tax Returns. Whatever date you set for the end of the. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

Trust and Estate Partnership. California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541. The estimated tax is payable in equal installments on or before April 15 June 15 September 15 and January 15.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. For trusts operating on a calendar year the trust tax return due date is April 15.

Certain Federal And Texas Tax Return Filing And Payment Due Dates Extended Graves Dougherty Hearon Moody

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

How Grantor Trusts And Alternatives Aid Estate Planning Granite Harbor

Don T Be Surprised By New Tax Filing Due Dates San Jose Cpa Firm

Extend 1041 Tax Return Deadlines For Your Trusts Estates With Form 7004

What Every Fiduciary Should Know About The 65 Day Rule Marcum Llp Accountants And Advisors

Pass Through Entities Fiduciaries Withholding Tax Return It 1140 Department Of Taxation

1041 Name Control Guidelines Ef Message 5300 Irs Reject R0000 901 01

News Alert Tax Return Due Dates Changes For 2016 Tax Year S J Gorowitz Accounting Tax Services

What Is A Schedule K 1 Form 1041 Estates And Trusts Turbotax Tax Tips Videos

Unexpected Tax Bills For Simple Trusts After Tax Reform

How To Obtain A Tax Id Number For An Estate With Pictures

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Instructions For Form 1041 U S Income Tax Return For Estates And Tr

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Irs Issues Universal Extension To July 15 2020 For 2019 1040 1041 And 1120 Returns